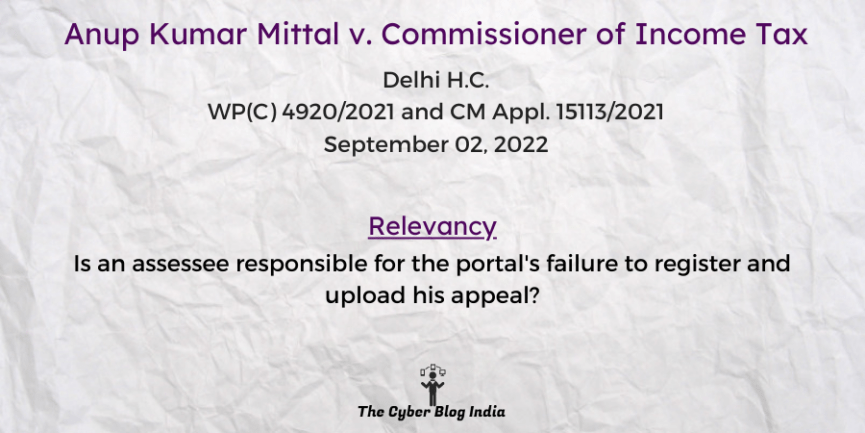

Anup Kumar Mittal v. Commissioner of Income Tax

Anup Kumar Mittal v. Commissioner of Income Tax

In the High Court of Delhi

WP(C) 4920/2021 and CM Appl. 15113/2021

Before Justice Manmohan and Justice M.P. Singh Arora

Decided on September 02, 2022

Relevancy of the Case: Is an assessee responsible for the portal’s failure to register and upload his appeal?

Statutes and Provisions Involved

- The Direct Tax Vivad Se Vishwas Act, 2020 (Section 2(1)(a))

Relevant Facts of the Case

- The petitioner had filed an appeal through the electronic mode; however, it was not registered and uploaded.

- As per the physical record of the appeal, it is still pending.

Opinion of the Bench

- The petitioner had filed the electronic appeal; there is no default on his part. The authorities cannot blame the petitioner for the portal’s failure to register and upload the appeal.

- It is settled law that an assessee cannot be penalised or suffer adverse consequences for default on the part of the Revenue.

- In the case of Shyam Sunder Sethi v. CIT, the court held that “an appeal would be ‘pending’ in the context of Section 2(1)(a) of the Direct Tax Vivad Se Vishwas Act, 2020 when it is first filed till its disposal.

Final Decision

- The court set aside the Commissioner’s order and directed to ensure that the petitioner’s appeal is uploaded and registered.

Aditi Mangesh Sawant, an undergraduate student at NMIMS Kirit P Mehta School of Law, Mumbai, prepared this case summary during her internship with The Cyber Blog India in January/February 2024.