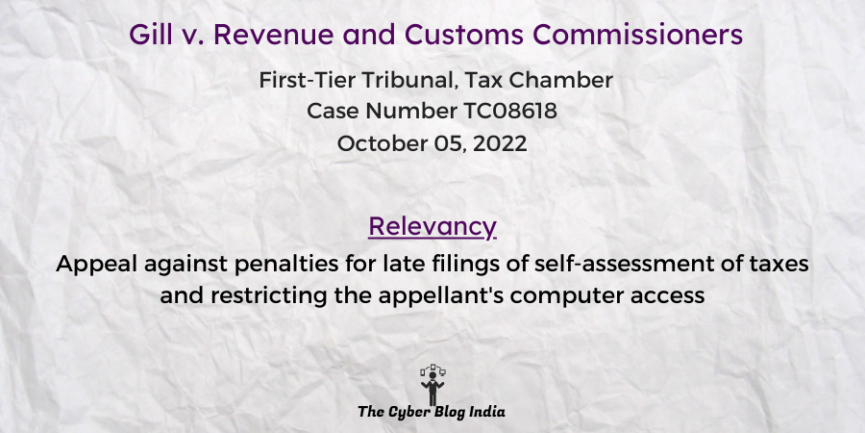

Gill v. Revenue and Customs Commissioners

Gill v. Revenue and Customs Commissioners [2022] UKFTT 00368 (TC) In the First-Tier Tribunal, Tax Chamber Case Number TC08618 Before Mr Greg Sinfield, Tribunal Judge and Mr John Agboola, Tribunal Member Decided on October 05, 2022 Relevancy of the Case: … Read More