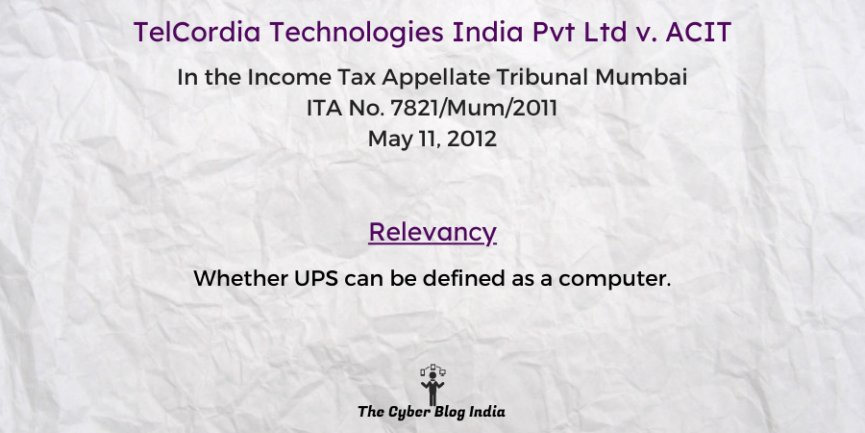

TelCordia Technologies India Pvt Ltd v. ACIT, CIR 3(3), Mumbai

TelCordia Technologies India Pvt Ltd v. ACIT, CIR 3(3), Mumbai

In the Income Tax Appellate Tribunal Mumbai Bench ‘E’

ITA No. 7821/Mum/2011

Before PM Jagtap, A.M. and Amit Shukla, J.M.

Decided on May 11, 2012

Relevancy of the case: Whether UPS can be defined as a computer?

Statutes & Provisions Involved

- The Information Technology Act, 2000 (Section 2(1)(i))

Relevant Facts of the Case

- The current appeal challenges the Assistant Commissioner of Income Tax’s order dated 19-10- 2011, under Section 143(3) read with Section 144C(13) for the assessment year 2007-2008.

- The ground of appeal on which the assessee has raised the issue is the application of depreciation of 60% on UPS instead of 15%.

- The assessee had purchased UPS (uninterruptible power supply) of 120 KVA + 40 KVA for the purpose of using the same for the unit. This was eligible for exemption under Section 10A, for various office items, data centre equipment, networking equipment, computer routers, switches, emergency lights, IT infrastructure and various other office equipment.

Opinion of the Bench

- The bench noted that various kinds of office equipment and plant and machinery use UPS.

- Per the case of Nestle India Ltd, The bench perused the definition of computer under the IT Act and the definitions of UPS from various sources.

- It further observed that the UPS is not built into the computer as a battery in the laptop. Hence, it is merely an external aid to the computer system by ensuring an uninterrupted power supply in an emergency and regulating the power flow.

- A computer system can function independently without the UPS. Moreover, UPS can ensure uninterrupted power supply to other equipment besides a computer. It is, thus, not an integral part of the computer system.

Final Decision

- The bench thus, entitled the appellant to a 15% depreciation on the purchased UPS.