Devanshu Infin Ltd. v. National E-Assessment Centre

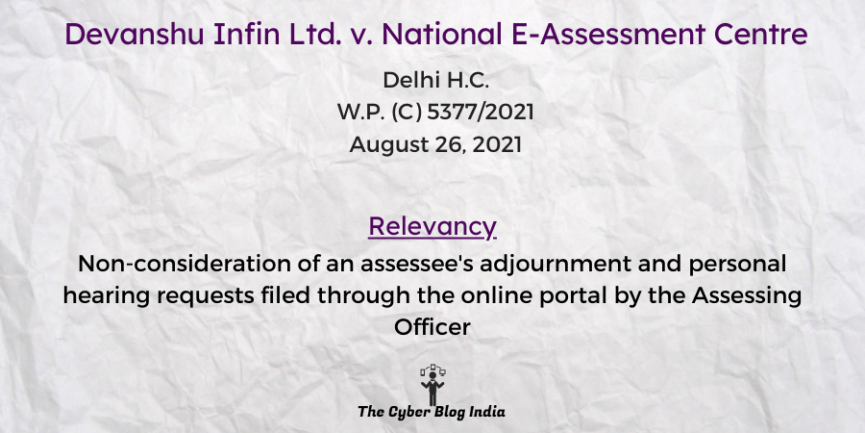

Devanshu Infin Ltd. v. National E-Assessment Centre

In the High Court of Delhi

WP(C) 5377/2021

Before Justice Manmohan and Justice Navin Chawla

Decided on August 26, 2021

Relevancy of the Case: Non-consideration of an assessee’s adjournment and personal hearing requests filed through the online portal by the Assessing Officer

Statutes and Provisions Involved

- The Income Tax Act, 1961 (Section 144(2), 144B)

Relevant Facts of the Case

- The respondent issued a show-cause notice dated April 07, 2021, giving the petitioner two days to submit its reply.

- The petitioner filed a request for adjournment dated April 9, 2021, requesting time till April 13, 2021. The petitioner filed a detailed response and requested a personal hearing through videoconferencing.

- The respondent passed an assessment order dated April 29, 2021, without providing any personal hearing as requested by the petitioner.

Prominent Arguments by the Advocates

- The petitioner’s counsel drew the court’s attention to the screenshot of the e-filing portal. The portal clearly gave time to the petitioner till April 15, 2021.

Opinion of the Bench

- The e-filing portal gave the petitioner time to file a reply till April 15, 2021, and the petitioner had requested a personal hearing.

- It was incumbent upon the respondent to have granted a personal hearing. Section 144B(7) of the Income Tax Act, 1961, provides an opportunity for personal hearing if requested.

Final Decision

- The court remanded the matter back to the assessing officer, who shall grant an opportunity for a personal hearing.

Aditi Mangesh Sawant, an undergraduate student at NMIMS Kirit P Mehta School of Law, Mumbai, prepared this case summary during her internship with The Cyber Blog India in January/February 2024.