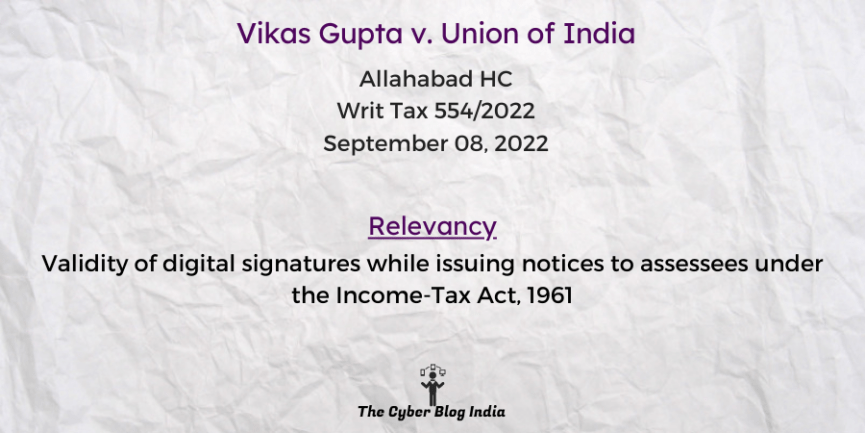

Vikas Gupta v. Union of India

Vikas Gupta v. Union of India

(2022) 448 ITR 1 : (2022) 328 CTR 1063

In the High Court of Allahabad

Writ Tax 554/2022

Before Justice S.P. Kesarwani and Justice C.K. Rai

Decided on September 08, 2022

Relevancy of the Case: Validity of digital signatures while issuing notices to assessees under the Income-Tax Act, 1961

Statutes and Provisions Involved

- The Information Technology Act, 2000 (Section 2, 66A)

- The Income-Tax Act, 1961 (Section 148, 151, 282A)

- The Income-Tax Rules, 1962 (Rule 127A)

Relevant Facts of the Case

- The Assessing Officer (AO) issued notices to the assessee under Section 148 of the Income-Tax Act, 1961 (“Act”).

- The Principal Commissioner of Income Tax (PCIT) did not grant approval to issue notices until after the AO issued notices to the assessee. This was not in accordance with the law. Moreover, PCIT granted approval in digital form.

- The assessee has filed this petition contesting the AO’s jurisdiction in issuing the notices.

Prominent Arguments by the Advocates

- The petitioner’s counsel submitted that the impugned notices are without jurisdiction and thus invalid. Further, the AO issued the notices without the approval of the competent authority as required by Section 151 of the Act. Also, the subsequent proceedings and reassessment orders are without jurisdiction.

- The Additional Solicitor General submitted that the unsigned satisfaction is valid, per Section 282A of the Act. Further, when the PCIT pushed in “Generate Tap in ITBA System”, his satisfaction would be deemed an authenticated document for Section 282A. Moreover, the digital signature affixed by PCIT after the notice issuance by the AO will not invalidate notices under Section 148 of the Act.

Opinion of the Bench

- When the AO issued notices to the assessees, the Prescribed Authority did not record any valid satisfaction under Section 151 of the Act.

- The AO issued notices without having jurisdiction to do so.

Final Decision

- The bench allowed the writ petition.

Palaaksha Kandhari, an undergraduate student at Symbiosis Law School, Hyderabad, and Saatvika Reddy Sathi, an undergraduate student at Jindal Global Law School, Sonipat, prepared this case summary during their internship with The Cyber Blog India in January/February 2023.