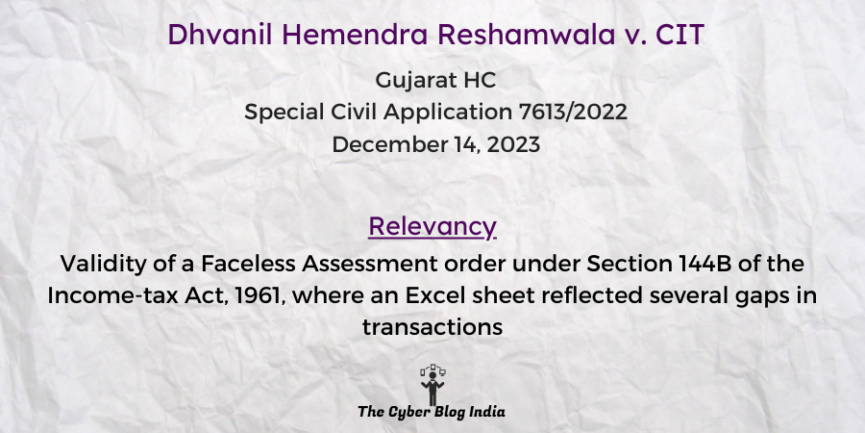

Dhvanil Hemendra Reshamwala v. CIT

Dhvanil Hemendra Reshamwala v. CIT In the High Court of Gujarat Special Civil Application 7613/2022 Before Justice Biren Vaishnav and Justice Nisha M. Thakore Decided on December 14, 2023 Relevancy of the case: Validity of a Faceless Assessment order under … Read More