Dhvanil Hemendra Reshamwala v. CIT

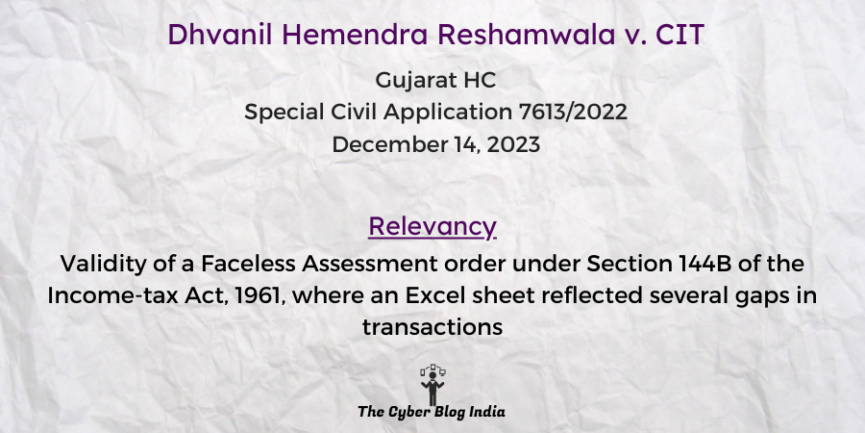

Dhvanil Hemendra Reshamwala v. CIT

In the High Court of Gujarat

Special Civil Application 7613/2022

Before Justice Biren Vaishnav and Justice Nisha M. Thakore

Decided on December 14, 2023

Relevancy of the case: Validity of a Faceless Assessment order under Section 144B of the Income-tax Act, 1961, where an Excel sheet reflected several gaps in transactions

Statutes and Provisions Involved

- The Information Technology Act, 2000 (Section 13)

- The Income-tax Act, 1961 (Section 142(1), 144B, 147, 148, 156)

- The Constitution of India, 1950 (Article 226, 227)

Relevant Facts of the Case

- The applicant filed the income tax return for 2016-17 on July 22, 2016. He received a notice to assess income under Section 148.

- On July 06, 2021, the department informed him of significant financial transactions exceeding taxable limits, identified during the search of the Navratna Group.

- The applicant contested the reasons for the notice, but the authority overseeing the challenge rejected them. This dispute centred on whether the Assessing Officer had the jurisdiction to issue the notice under Section 148.

- Further, the department issued a notice under Section 142(1) requesting him to furnish the documents supporting the transactions entered during the assessment proceedings.

- He submitted an explanation and the relevant documents highlighting the transactions with Navratna Group.

- The applicant received the final assessment order under Section 147, read with Section 144B and a demand notice of ₹28,09,842 under Section 156.

- The applicant has directly approached the court in writ jurisdiction, praying to quash and set aside the final order and demand notice raised by the Department.

Prominent Arguments by the Advocates

- The applicant’s counsel argued that the respondent authorities failed to comply with the mandatory procedure of Faceless Assessment under Section 144B. The department passed the final assessment order without providing a copy of a draft assessment order and curtailed the opportunity to object to it.

- The respondent’s counsel submitted that the assessment order was passed without serving a draft order upon the writ applicant. Therefore, the court may pass the appropriate order.

Opinion of the Bench

- The court confirmed the non-service of the draft assessment order, required to be sent along with the show cause notice as per Section 144B(1)(xvi)(b) of the Income-Tax Act, 1961.

- The impugned order of assessment is invalid and non-est. It is passed in gross violation of the principles of natural justice and mandatory provision.

Final Decision

- The court set aside the final assessment order and demand notice.

- The court remanded the matter back to the Assessing Officer.