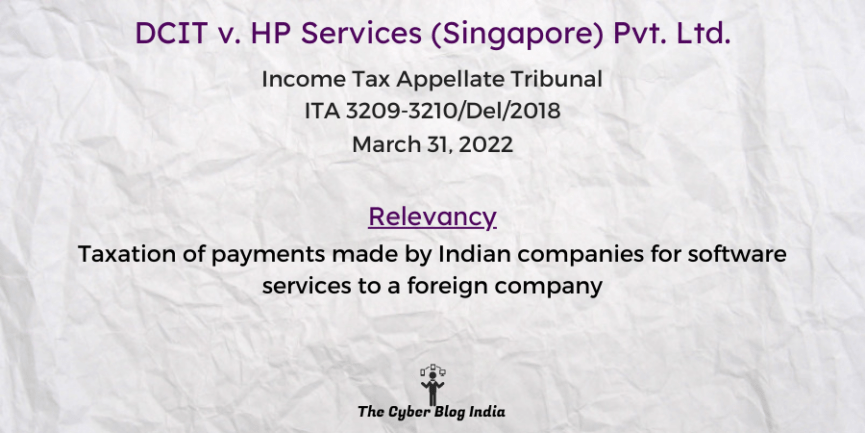

DCIT v. HP Services (Singapore) Pvt. Ltd.

DCIT v. HP Services (Singapore) Pvt. Ltd.

In the Income Tax Appellate Tribunal

ITA 3209-3210/Del/2018

Before Mr R.K. Panda, Administrative Member, and Mr NK Choudhry, Judicial Member

Decided on March 31, 2022

Relevancy of the case: Taxation of payments made by Indian companies for software services to a foreign company

Statutes and Provisions Involved

- The Income Tax Act, 1961 (250(6), 143(2), 144C, 143(3))

- The Indian Penal Code, 1860 (Section 420, 465, 468, 471)

Relevant Facts of the Case

- The respondent is a company incorporated under the laws of Singapore and filed a return of income online.

- The AO under Section 143(2) scrutinised the returns and added two income accounts from selling off-shelf software from outside India.

- This addition aggrieved the assessee. The assessee appealed before the Learned Commissioner, who deleted these additions.

- This order of the Learned Commissioner aggrieved the Revenue Department. Hence, they have filed this appeal.

Prominent Arguments by the Advocates

- The appellant’s counsel argued that the Singapore company gave services to many Indian companies. Thus, the AO was justified in considering the income from Indian companies to be royalty. The assessee had the right to reproduce the software application; it was a passing right to customers. Hence, these payments should come under royalty.

- The counsel further submitted that the petitioner had been given the right to reproduce the software, thus passing a right to customers. Therefore, the payment has to be considered royalty.

- The assessee’s counsel argued that the agreement between Microsoft and the respondent does not provide for passing a right to its customers. Further, Microsoft’s software products are not taxable in India as royalty as per Section 9(1)(vi) of the Income Tax Act, 1961, read with Article 12 of Indo-US DTAA.

Opinion of the Bench

- The AO cannot categorise these payments as royalties for taxation.

Final Decision

- The court dismissed the appeal.