Munjal BCU Centre of Innovation and Entrepreneurship v. CIT

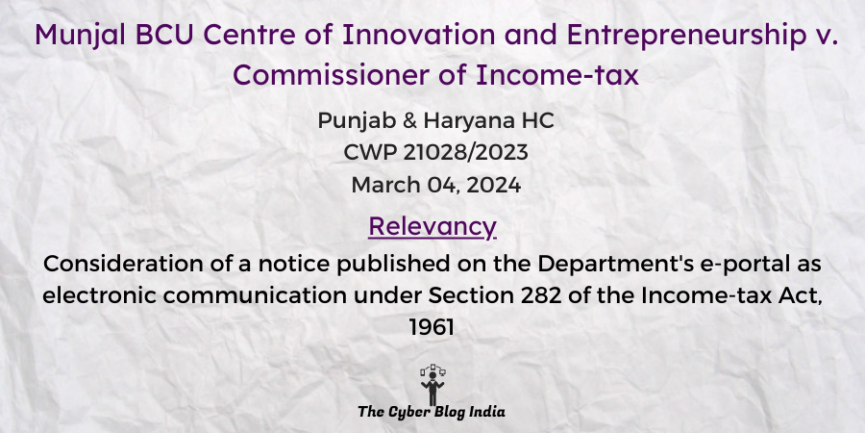

Munjal BCU Centre of Innovation and Entrepreneurship v. Commissioner of Income-tax

In the High Court of Punjab & Haryana

CWP 21028/2023

Before Justice Sanjeev Prakash Sharma and Justice Sudeepti Sharma

Decided on March 04, 2024

Relevancy of the case: Consideration of a notice published on the Department’s e-portal as electronic communication under Section 282 of the Income-tax Act, 1961

Statutes and Provisions Involved

- The Income-tax Act, 1961 (Section 12A(1)(ac)(iii), 282(1))

- The Income-tax Rules, 1962 (Rule 127(1))

- The Constitution of India, 1950 (Article 226)

- The Code of Civil Procedure, 1908 (Section 151)

Relevant Facts of the Case

- The Commissioner of Income-tax (“CIT”) issued a show cause notice to the appellant for initiating proceedings under Section 12A of the Income-tax Act, 1961.

- The Department only reflected the notice on its e-portal and did not send it to the appellant’s email or any other means.

- Afterwards, they published two reminders concerning the show cause notice on their e-portal.

- The appellant has applied to the court to stay the operation of the show cause notice.

Prominent Arguments by the Advocates

- The appellant’s counsel submitted that the notice and reminders were not served on the appellant because no email was sent.

- The respondent’s counsel submitted that:

- The electronic communication of notice includes communication of notice by placing it in an e-portal.

- The appellant had submitted its form on the Department’s e-portal. Hence, they knew of the notice. Therefore, there was no requirement to serve the notice through email or other means.

Opinion of the Bench

- The Department has not given sufficient opportunity to the appellant to put up its plea regarding the proceedings.

- The appellant is entitled to file a reply. The Department should then examine the matter and pass a fresh order.

Final Decision

- The court allowed the writ petition.