Saravana Selvarathnam Retails Pvt. Ltd. v. Commissioner of Income-tax

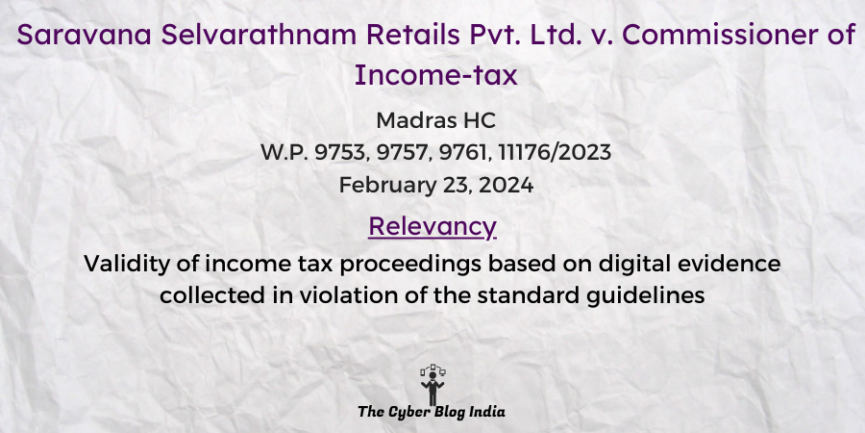

Saravana Selvarathnam Retails Pvt. Ltd. v. Commissioner of Income-tax

In the High Court of Madras

W.P. 9753, 9757, 9761, 11176/2023

Before Justice Krishnan Ramasamy

Decided on February 23, 2024

Relevancy of the case: Validity of income tax proceedings based on digital evidence collected in violation of the standard guidelines

Statutes and Provisions Involved

- The Information Technology Act, 2000 (Section 2, 67)

- The Indian Penal Code, 1860 (Section 120B, 499)

- The Income Tax Act, 1963 (Section 119)

Relevant Facts of the Case

- The first respondent searched and seized electronic data from the petitioner’s premises without a warrant. The collection and preservation of the seized data did not follow the procedure established by the Digital Evidence Investigation Manual (“Manual”).

- The second respondent passed three oral orders against the petitioner without allowing him to examine the digital data collected from the premises. The respondent also refused to allow him to cross-examine the witnesses and a personal hearing.

- The petitioner filed a writ petition challenging the admissibility of evidence that the second respondent relied on in the above orders.

- The second respondent passed another assessment order and refused to grant the petitioner an opportunity for a personal hearing.

- The petitioner filed an appeal against the four oral orders with the appellate authority and subsequently filed a writ petition before the High Court in the instant case.

Prominent Arguments by the Advocates

- The petitioner’s counsel argued that:

- These writ petitions are an exception to the alternate remedy available and are maintainable. The authority’s search was invalid, and the evidence was not admissible.

- The Manual is binding in nature and the authority did not follow it. It relied on its discretion and violated the principles of natural justice. The counsel referred to Dhakeswari Cotton Mills Ltd. v. CIT for this. Additionally, the warrant did not mention the petitioner’s entity, but the authorities searched its premises.

- The authority mechanically relied on it without corroborating it. Further, they did not allow a cross-examination or a personal hearing, thus violating the principles of natural justice.

- The respondent’s counsel submitted that:

- The writ petition is not maintainable as the petitioner has also invoked the authority’s appellate jurisdiction.

- Additionally, unlike other authorities, an Income Tax Officer’s investigative authority can rely on evidence and be based on discretion. It can also exercise volition when it comes to following the Manual.

- The premise search was also valid, as a search warrant was issued for the address provided, not a particular floor. He also contended that the search followed the fundamental procedure.

Opinion of the Bench

- The Manual, introduced by the Central Board of Direct Taxes, had statutory force. An affected party can challenge the collection of evidence in violation of its provisions before a court of law. The writ petition was an exemption to the alternative remedy of an appeal and was maintainable.

- The respondent failed to comply with the procedural requirements for the collection and preservation of digital data under the Manual. Under such circumstances, the authority had to substantiate the collected digital evidence with corroborative evidence.

- The failure to adduce corroborative evidence, allow the petitioner to cross-examine witnesses, and allow the petitioner to access the complete evidence violated the principles of natural justice.

- Remitting the case for re-adjudication was necessary as the search and seizure was improper.

Final Decision

- The court disposed of the writ petitions and set aside the four impugned assessment orders. Further, the court directed the authority to re-adjudicate the entire matter again.

Jyotsna Sood and Nandita Karan Yadav, undergraduate students at the National Law Institute University, Bhopal, prepared this case summary during their internship with The Cyber Blog India in May/June 2024.