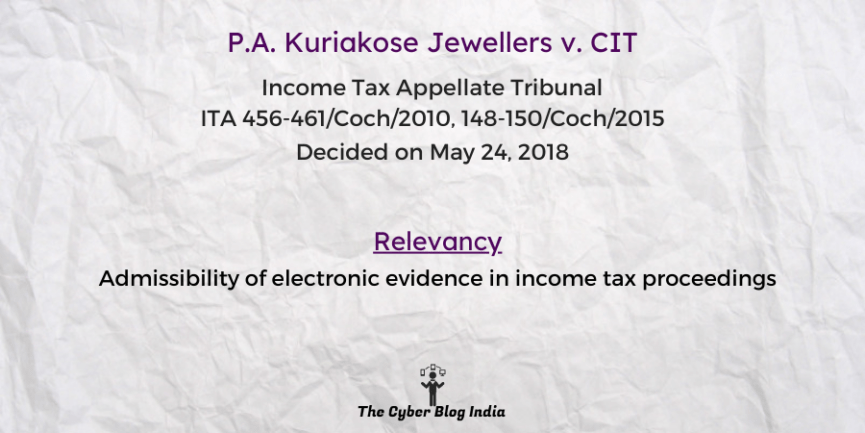

P.A. Kuriakose Jewellers v. CIT

P.A. Kuriakose Jewellers v. CIT

In the Income Tax Appellate Tribunal

ITA 456-461/Coch/2010, 148-150/Coch/2015

Before Mr Chandra Poojari (Accountant Member) and Mr George George K (Judicial Member)

Decided on May 24, 2018

Relevancy of the Case: Admissibility of electronic evidence in income tax proceedings

Statutes and Provisions Involved

- The Information Technology Act, 2000 (Section 2(1)(t), 93)

- The Indian Evidence Act, 1872 (Section 65A, 65B)

- The Income Tax Act, 1961 (Section 132, 143, 153A, 260A, 271)

Relevant Facts of the Case

- The revenue authorities conducted search and seizure on the assessee’s premises and accordingly did the assessment.

- The aggrieved assessee approached the Income Tax Appellate Tribunal and then the High Court. The High Court remanded the case to the tribunal with the liberty to the parties to raise additional grounds.

- The assessee raised the question of the admissibility of electronic records recovered during the search on the ground of non-compliance with Section 65A and 65B of the Evidence Act, 1872.

- The tribunal has to decide on the admissibility of this additional ground.

Prominent Arguments by the Advocates

- The appellant’s counsel submitted that the tax authorities seized the loose computer sheets and the central processing unit (CPU) during the search without complying with Section 65B of the Evidence Act, 1872.

Opinion of the Bench

- Section 132(1)(iib) of the Income Tax Act, 1961 adopts the definition of electronic record provided in Section 2(1)(t) of the Infomation Technology Act, 2000.

- The data recovered from the computer’s central processing unit (CPU) is important evidence.

- The determination of the question of admissibility of the electronic records without complying with the Evidence Act, 1872 is essential.

Final Decision

- The appellate tribunal allowed the additional ground for compliance with Section 65 of the Indian Evidence Act, 1872.