Bellences v. Hungary

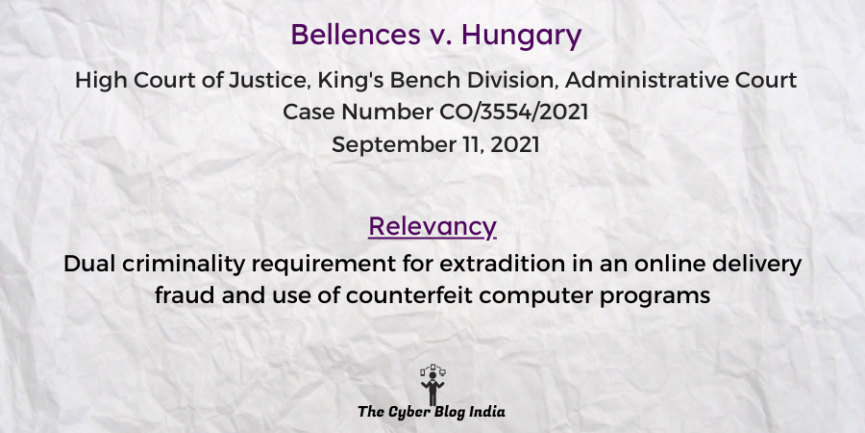

Bellences v. Hungary

[2023] EWHC 2235 (Admin)

In the High Court of Justice, King’s Bench Division, Administrative Court

Case Number CO/3554/2021

Before Justice Heather Williams

Decided on September 11, 2021

Relevancy of the case: Dual criminality requirement for extradition in an online delivery fraud and use of counterfeit computer programs

Statutes and Provisions Involved

- The Extradition Act 2003 (Sections 2, 10, 26, 27, 65)

- The Forgery and Counterfeiting Act 1981 (Sections 1, 3, 9)

- The Computer Misuse Act 1990 (Section 1)

Relevant Facts of the Case

- The appellant purported to sell digital devices such as computers to aggrieved parties in exchange for sums of money. He requested the payment in cash upon delivery of the parcels.

- The aggrieved parties duly paid the sum on their ends. However, they lost their funds as the delivered parcels contained worthless items.

- He relied upon fictitious information to hide his identity from the recipients by providing forged return receipts to the post office concerned.

- He also used illegally copied copyrighted programmes, which caused losses of royalties to the distributors of the programmes.

- A Hungarian court issued a conviction arrest warrant (“AW1”), convicting the appellant of 48 offences and the specified offences. The District Court upheld the extradition concerning the specified offences.

- In the instant case, the court considered five of these offences to ascertain the requirement of “dual criminality” under Section 65 of the Extradition Act 2003.

- Regarding these offences, the District Judge allowed for the appellant’s extradition when he failed to engage with the proceedings. The appellant filed an appeal against the District Judge’s decision.

Prominent Arguments by the Counsels

- The appellant’s counsel argued that:

- The appellant’s conduct would not amount to offences under the Forgery and Counterfeiting Act 1981.

- The receipts did not constitute “false instruments” as per Section 9(1)(g) since they were made in the circumstances in which they had been claimed to be made. The relevant circumstances, viz., the existence of a sender and a parcel, were true.

- The appellant had not intended to induce the recipients to act to their “prejudice”. The parties would incur financial losses regardless of the alleged forgery. The parties had incurred losses due to fraud, which was beyond the scope of the instant appeal.

- The respondent had failed to prove that the appellant’s access was “unauthorised” under Section 17(5).

- It was unclear if a lack of consent from the copyright owner constituted unauthorised access.

- He suggested that the Parliament had not intended to criminalise non-commercial private copying of software under Section 1 of the Computer Misuse Act 1990. This is indicated by the Copyright, Designs and Patents Act 1988.

- The respondent’s counsel submitted that:

- The receipts constituted “false instruments” since the appellant’s use of fictitious sender details purported that the receipts were made in circumstances different from those in which they were made.

- The appellant’s conduct intended to induce the recipients to accept the parcels to their “prejudice”. The recipients had no option to return the parcels.

- The appellant’s use of his computer to obtain unauthorised access to copyrighted material and illegally copying it onto his hard drive would amount to offences under Sections 1 and 17 of the Computer Misuse Act 1990. He knew the material’s copyrighted status and had not paid the necessary royalties.

- Additionally, the absence of an earlier statute criminalising certain conduct would not preclude a later legislation from considering it as an offence.

Opinion of the Bench

- The respondent failed to show that the appellant’s conduct was a criminal offence under domestic law.

- The respondent failed to establish the essential elements of the statutory definition of “forgery” to constitute an offence under domestic law. The counsel could not prove the appellant’s intention to induce another to act to their prejudice and the falsity of the receipts.

- The respondent did not prove, beyond a reasonable doubt, that the appellant accessed programs without authorisation. They also failed to establish that the appellant knew it was unauthorised under Section 1(1)(c).

Final Decision

- The court allowed the appellant’s appeal, holding that the alleged offences in AW1 are not extradition offences.

Jyotsna Sood, an undergraduate student at the National Law Institute University, Bhopal, prepared this case summary during her internship with The Cyber Blog India in May/June 2024.